This is because EMIsĪre computed on a reducing balance method, which works in your favour as a borrower.Īt your request, you are being redirected to a third party site. With sufficient work experience, a good number of years before retirement, have low or no EMIs, and your credit score is respectable (750 and above), you could be eligible for a personal loan at an attractiveĭo note that during the initial months of the loan tenure, you pay more towards interest, and gradually, as you repay the loan, a higher portion is adjusted towards the principal component. If you are young and earning a decent, steady source of income Similarly, a shorter loan tenure increasesĪxis Bank offers Personal Loan at a competitive rate of interest. Higher the interest rate on the loan, higher will be your EMI and vice-versa. Remember, the interest rate and your loan tenure are the vital deciding factors for your loan EMI. For instance, if R = 15.5% per annum, then R= 15.5/12/100 = 0.0129.įinding it complicated? Don’t worry! Use Axis Bank’s Personal Loan EMI calculator. The rate of interest (R) on your loan is calculated monthly i.e. So, say you are applying for a personal loan from Axis Bank, amounting to Rs 2,00,000 at a rate of interest of 15.5% p.a. Mathematically, EMI is calculated as under: The EMI, usually, remains fixedįor the entire tenure of your loan, and it is to be repaid over the tenure of the loan on a monthly basis. Therefore, EMI = principal amount + interest paid on the personal loan. The Equated Monthly Instalment (or EMI) consists of the principal portion of the loan amount and the interest. Whatsoever, whether in contract, tort, misrepresentation or otherwise arising from the use of these tools/ information contained / data generated herein. Neither Axis Bank nor any of its agents or licensors or groupĬompanies shall be liable to user/ any third party, for any direct, indirect, incidental, special or consequential loss or damages (including, without limitation for loss of profit, business opportunity or loss of goodwill) No claim (whether in contract, tort (including negligence) or otherwise) shall arise out of or in connection with the services against Axis Bank. Axis Bank does not undertake any liability or responsibility to User should exercise due care and caution (including if necessary, obtaining of advise of tax/ legal/ accounting/įinancial/ other professionals) prior to taking of any decision, acting or omitting to act, on the basis of the information contained / data generated herein. The use of any information set out is entirely at the User's own risk. Herein or on its completeness / accuracy. Pradhan Mantri Jeevan Jyoti Bima YojanaĪxis Bank does not guarantee accuracy, completeness or correct sequence of any the details provided therein and therefore no reliance should be placed by the user for any purpose whatsoever on the information contained / data generated.Commercial Vehicle & Construction Equipment Loan.It’ll take less than ten minutes to fill out, and you’ll get an instant decision based on your current financial situation and loan amount. If you’re happy with the estimated monthly repayment figure, click ‘Apply Now’ and fill out our quick and easy online application form. You can borrow between £25,001-£35,000 over a period of 4 to 5 years only (48 months to 60 months).You can borrow between £7,500-£25,000.99 over a period of 2 to 7 years only (24 months to 84 months).You can borrow between £1,000-£7499.99 over a period of 2 to 5 years only (24 months to 60 months).The loan amount should be between £1,000 and £35,000 only.

You can also find out how much you could borrow based on your monthly budget, which will help to make sure you don’t apply for a loan that might be difficult to repay. The rate you’re offered once you’ve completed an application form will be based on your personal circumstances, loan amount and term.įind out estimated monthly repayments on a specific loan amount in seconds. Our advertised rate demonstrates the rate at least 51% of our customers are offered, giving you a realistic idea of the type of APR to expect when you apply with us. We’ll then show you estimated monthly repayment costs and total amount payable, based on our advertised rate.

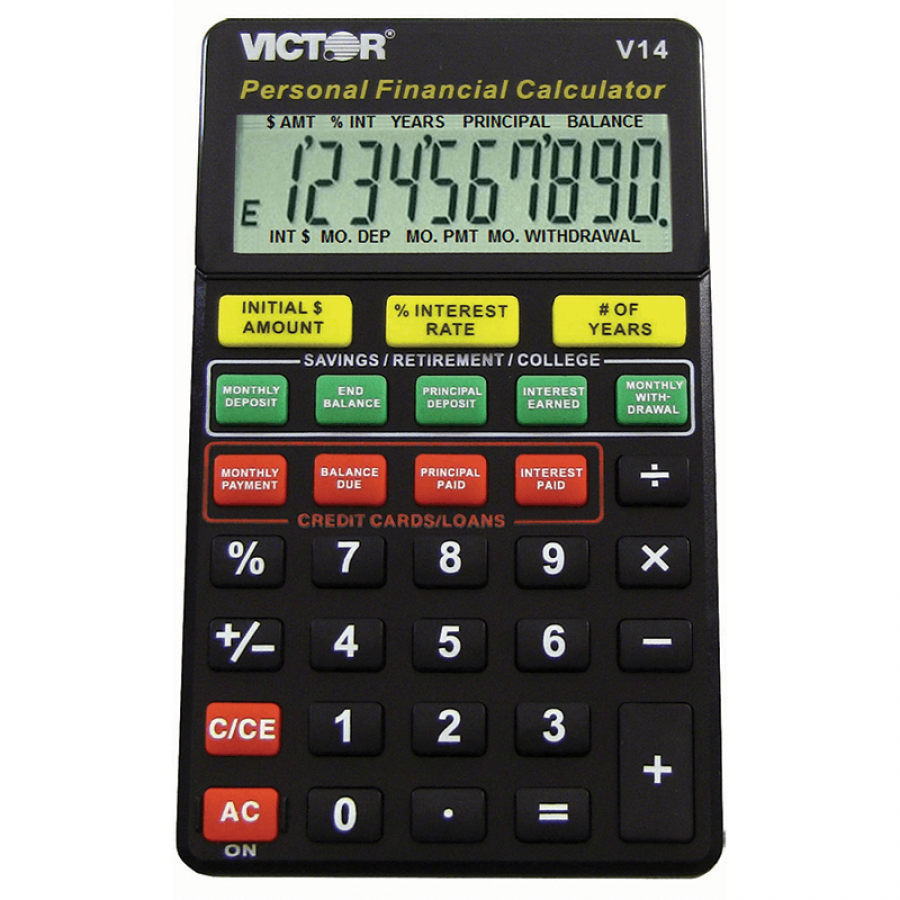

PERSONAL FINANCE CALCULATOR PLUS

You can use the plus or minus keys or type into the field.

Simply enter the loan amount (or your monthly budget) and term. It’s easy to use our quick personal loan calculator.

0 kommentar(er)

0 kommentar(er)